Financial Management Theories

Financial Management Theories: When we talk about financial management, we mean how people and businesses plan, control, and use money wisely. Good financial management helps a business stay healthy, grow safely, and avoid big risks.

In this article we’ll explore “Financial Management Theories with Examples” so you can see how different ideas help with real financial decisions. We’ll keep the language simple, use clear examples, and show how these theories apply both in business and everyday life.

What is Financial Management?

Financial management is the art and science of handling money: planning how much money is needed, organizing it, directing how it’s used, and controlling it to reach goals. With good financial management, a business can pay its bills, invest in growth, and respond to change with confidence.

Key parts of financial management include:

- Deciding where the funds come from (internal cash, debt, equity)

- Deciding how the funds are used (investment, operations, expansion)

- Monitoring the results and adjusting as needed

When we discuss financial management theories, we are talking about ideas and models that help explain how and why firms make those decisions. Understanding these theories gives you strong tools to make better financial management decisions yourself.

Why Financial Management Theories Matter?

When you learn financial management theories with examples, you gain insight into:

- How firms choose the right mix of debt and equity

- How investors price risk and return

- How managers may act, and how incentives affect behaviour

- How markets and firms allocate resources

By using these theories in practice, you improve your chance of doing smart financial management. They help you go beyond gut feelings and move toward structured thinking.

Best Financial Management Theories – Overview

Below are several of the best financial management theories, each with a simple explanation and a concrete example. We use the focus keyword Financial Management Theories with Examples evenly across the article.

Theory 1: The Trade-Off Theory

The trade-off theory is about balancing benefits and costs when choosing a debt level. It argues that a firm will borrow up to a point where the benefit of borrowing (like tax savings) equals the cost of borrowing (risk of bankruptcy, cost of distress).

Example:

A small manufacturing company realises if it borrows money, it gets tax savings from interest payments. But if it borrows too much debt, it risks not paying back and facing bankruptcy. It chooses just enough debt so that the extra benefit of another unit of debt equals the extra risk cost. This illustrates how financial management uses the trade-off theory in real decisions.

Theory 2: The Pecking Order Theory

The pecking order theory says that firms prefer to use internal funds first, then debt, and only issue equity as a last resort. Because issuing equity may signal bad news or cost more.

Example:

Imagine a tech startup has saved profit (retained earnings). It uses that to fund growth. When that runs out, it borrows bank debt. If growth still needs more funds and debt capacity is exhausted, it issues new shares. That ordering reflects the pecking order theory. It shows how financial management uses theory to decide source of funds.

Theory 3: Agency Theory

Agency theory deals with conflicts between owners (principals) and management (agents). The issue: managers may act in their own interest rather than owners’ interest. The theory suggests ways to align their interests.

Example:

A company gives its CEO stock options so that when share price rises, CEO benefits too. That aligns the manager’s interests with the shareholders. That is a financial management decision guided by agency theory.

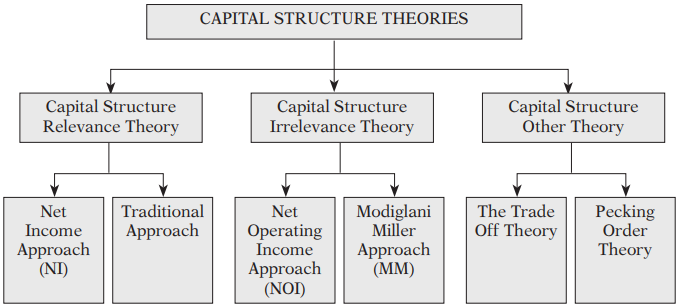

Theory 4: Capital Structure Theory / Net Income & Net Operating Income Approach

These theories explain how debt and equity mix (capital structure) affects a firm’s value and cost of capital. They include earlier approaches (net income, net operating income, traditional) and more modern ones like the Modigliani‑Miller theorem.

Example:

A company uses a formula to show if it increases debt, cost of debt is low and cost of equity rises; the WACC (weighted average cost of capital) might fall, improving firm value. That decision links to financial management theory about capital structure.

Theory 5: Efficient Market Hypothesis (EMH)

The efficient market hypothesis says markets reflect all available information, so it is hard to “beat the market” consistently.

Example:

An investor looks at publicly available info about a company; because the market already priced it in, the investor finds it hard to gain above-average returns without taking extra risk. This informs how financial management sees investment decisions.

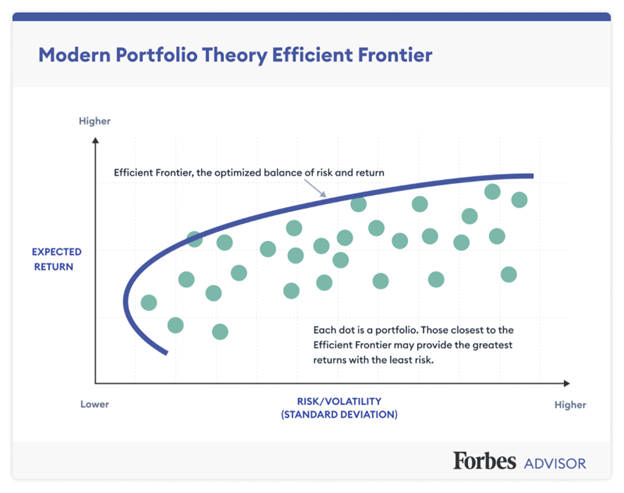

Theory 6: Modern Portfolio Theory (MPT)

The modern portfolio theory, introduced by Harry Markowitz, emphasises diversification: you should choose a mix of assets to maximise return for a given risk.

Example:

A household invests in stocks, bonds, real estate rather than just one stock. By doing this, it reduces risk of big loss. In financial management for a firm or individual, using MPT is an example of applying theory for managing resources.

How to Use Financial Management Theories with Examples in Real Life

Understanding theory is one part; applying it is the next. Here is how to apply the concept of Financial Management Theories with Examples in daily or business life.

Step 1: Identify the decision you need to make

For example: Should your company take on more debt? Should you use retained earnings or issue shares? Should you invest in a new asset?

Step 2: Choose the relevant theory

- If decision is about debt vs equity → use trade-off theory or pecking order theory.

- If decision is about aligning incentives → agency theory.

- If decision is about investment portfolio → MPT.

- If decision is about market behaviour → EMH.

Step 3: Gather the data & analyse

Use financial numbers: cost of debt, cost of equity, expected returns, risk, market info.

Step 4: Map the example

Plug the real-life numbers into an example: e.g., Company A borrows $100,000 at 5% interest, tax rate 30%, expected benefit is tax shield of $15,000 etc. That is a example of theory in action.

Step 5: Make the decision and monitor

After applying the theory, decide. Then monitor actual outcomes: did the cost of capital fall? Did risk increase? Adjust as needed.

Four Common Mistakes in Financial Management Theories & How to Avoid Them

Even with strong theories, mistakes happen. Here are some common pitfalls and how to avoid them, using the lens of Financial Management Theories with Examples.

- Mistake 1: Ignoring real-life constraints

A theory may assume perfect markets (e.g., Modigliani-Miller). In real life there are taxes, bankruptcy costs, information asymmetry. Always adapt the theory to reality. - Mistake 2: Using theory without real numbers or example

You read the theory but never apply with actual figures. Use an example to check. - Mistake 3: Over-diversification or ignoring objectives

With MPT you might diversify so much you dilute return—or ignore your actual goals. Always tie back to your goal. - Mistake 4: Ignoring behaviour and incentives

Agency issues still exist. A manager may take on high risk even if theory says optimal debt level is lower. You must look at human behaviour.

FAQ – Financial Management Theories with Examples

1. What does “Financial Management Theories with Examples” mean?

It means learning the key theories that guide financial decision-making (like trade-off theory, pecking order theory) and seeing real-life or simple numerical examples that show how these theories apply. This helps understand both idea and practice.

2. Can a small business use these financial management theories?

Yes. Even small firms can apply concepts. For example, a small café deciding whether to borrow for expansion can use trade-off theory. A sole proprietor evaluating risk in investments can use MPT ideas. The key is adapting to scale.

3. Which theory is the best for financial management?

There is no single “best” theory. The best theory depends on the decision at hand. For capital structure, trade-off and pecking order are powerful. For portfolio decisions, MPT is excellent. Using multiple theories gives strong insight.

4. Are these theories always accurate?

Theories simplify reality. They rely on assumptions. For example, EMH says markets are efficient but real life shows anomalies. So the theories are tools, not guarantees. Use examples, check results, and adjust accordingly.

5. How often should I review decisions based on these theories?

Regularly. Financial markets and business environments change. A decision made today may need re-evaluation in six months or a year. Use the theory and example today, monitor tomorrow, and reassess when conditions shift.

Conclusion

Understanding Financial Management Theories with Examples gives you a strong foundation for making smart financial decisions. Whether you run a business or manage personal finances, knowing how theories like trade-off theory, pecking order, agency theory, capital structure models, efficient market hypothesis and modern portfolio theory work—and seeing examples of them—makes the difference between guess-work and informed action.

Keep in mind:

- Use people-first thinking: make decisions that serve human goals, not just numbers.

- Use the theories as tools, not rigid rules.

- Apply each theory with a concrete example to ground understanding.

- Monitor outcomes and revise as needed.

When you blend clear examples with solid theory, your financial management becomes richer, more grounded, and more likely to succeed.

I hope this article helps you feel confident in using financial management theories in your own world. Let me know if you’d like to explore any one theory in more depth with more detailed examples!