FAFSA for Undocumented Students in 2026

FAFSA for Undocumented Students in 2026: Navigating college finances can feel overwhelming, especially if you’re an undocumented student or part of a mixed-status family. The FAFSA for undocumented students in 2026 remains a key tool, even though federal aid isn’t available to everyone. While undocumented individuals.

Including DACA recipients, can’t access federal grants or loans, filling out the form can unlock state and school-based support. In this guide, we’ll break down eligibility rules, application steps, state alternatives, and more to help you make informed decisions about funding your education.

Whether you’re a high school senior eyeing college or a current student renewing aid, understanding these options is crucial. With recent updates to the FAFSA process and varying state policies, 2026 brings both challenges and opportunities. Let’s dive in and explore how you can maximize your chances for financial help.

Understanding FAFSA Basics for Undocumented Students

The Free Application for Federal Student Aid (FAFSA) is the starting point for most college funding in the U.S. It’s a form that assesses your financial need and determines eligibility for various types of aid. For the 2026-2027 academic year, which runs from July 1, 2026, to June 30, 2027, the FAFSA opened on October 1, 2025. The federal deadline is June 30, 2027, but many states and schools have earlier cutoffs—often as soon as March 2, 2026, for priority consideration.

For undocumented students, the FAFSA isn’t just about federal money. Even if you’re ineligible for Pell Grants, federal work-study, or Direct Loans, submitting the form can qualify you for state aid in certain places. It’s like a gateway to other resources. Think of it this way: without it, you might miss out on scholarships or grants from your college that use FAFSA data to award funds.

One big misconception is that undocumented students shouldn’t bother with the FAFSA at all. That’s not true. If you’re in a mixed-status family—say, you’re a U.S. citizen but your parents are undocumented—the form is essential for you to access federal aid. Your parents’ status doesn’t disqualify you; they can even contribute their info without a Social Security Number (SSN) by creating a StudentAid.gov account.

Eligibility Rules for Federal Aid in 2026

Let’s get straight to the facts: Undocumented students and DACA recipients are not eligible for federal student aid in 2026. Federal law limits Title IV aid—like Pell Grants and federal loans—to U.S. citizens and eligible noncitizens, such as permanent residents or those with certain visas. If you’re undocumented, you’ll select “Neither U.S. citizen nor eligible noncitizen” on the citizenship question.

That said, eligibility hasn’t changed dramatically for 2026. The FAFSA Simplification Act, which rolled out in previous years, made the form easier with fewer questions and a new Student Aid Index (SAI) replacing the old Expected Family Contribution (EFC). The SAI helps calculate need-based aid, but it doesn’t expand federal access for undocumented folks.

Updates from the One Big Beautiful Bill Act (OBBBA). Enacted in July 2025, include things like exempting family farms and small businesses from asset calculations and adding foreign income to AGI for Pell eligibility. These tweaks aim to direct aid to those with greater need, but they don’t alter the core rule: no federal aid for undocumented students.

If you’re a DACA student, the same applies. DACA provides work authorization and deportation protection, but it doesn’t confer eligible noncitizen status for federal aid. However, having an SSN from DACA means you can fill out the FAFSA more easily, which is helpful for state or institutional programs.

For mixed-status families, there’s good news. If the student is a citizen or eligible noncitizen, parents without SSNs can still provide their financial details online. They just leave the SSN field blank and use an Individual Taxpayer Identification Number (ITIN) if they have one. This ensures the student’s eligibility isn’t blocked.

Step-by-Step: How to Fill Out the FAFSA for Undocumented Students in 2026

Even if federal aid is off the table, completing the FAFSA can be worthwhile. Here’s how to do it right.

First, create a StudentAid.gov account. Anyone without an SSN can do this—it’s free and straightforward. Gather documents like 2024 tax returns (for the 2026-2027 form), bank statements, and records of any untaxed income. If parents or spouses are contributors, they’ll need to consent to IRS data transfer, even if they didn’t file U.S. taxes.

On the form, answer honestly about citizenship. For undocumented students, select the non-eligible option. List up to 20 schools you’re considering—their financial aid offices might use your FAFSA to award non-federal help.

If you’re in a state that requires the FAFSA for state aid, submit it by the local deadline. For example, California uses it alongside the California Dream Act Application (CADAA) for undocumented students. Sign electronically with all contributors’ approval, and keep an eye on your email for the FAFSA Submission Summary.

Pro tip: If the form feels tricky, reach out to your school’s financial aid office or a high school counselor. They can guide you through snags, like handling parents without SSNs.

State Aid Options for Undocumented Students in 2026

While federal doors are closed, states step up in big ways. As of 2026, 22 states plus D.C. offer in-state tuition to undocumented students, and 18 of those plus D.C. provide state financial aid. This is a game-changer, as in-state rates can slash tuition costs by thousands.

Here’s a breakdown of key states:

- California: Undocumented students use the CADAA instead of FAFSA for state grants like Cal Grants and university aid. Priority deadline: March 2, 2026. AB540 eligibility requires attending a California high school for three years and signing an affidavit.

- Illinois: The RISE Act lets undocumented students apply for state aid via the Alternative Application. For 2026-2027, meet high school or community college pathways for in-state tuition and grants.

- New York: Offers the Excelsior Scholarship and other state aid to qualifying undocumented residents. Check with SUNY or CUNY financial aid offices.

- Texas: Provides in-state tuition but limited state aid; recent changes might affect access, so verify with schools.

- Florida: Unfortunately, a 2025 law repealed in-state tuition waivers for undocumented students, potentially increasing costs. Explore private scholarships as alternatives.

Other supportive states include Maryland, New Jersey, Washington, and Virginia. If your state isn’t on the list, look into “locked-out” options like those from TheDream.US for residents in prohibitive areas.

To boost SEO, link internally to related posts on your site, like “Top Scholarships for DACA Students,” and externally to official resources such as studentaid.gov or your state’s aid commission site. This builds authority and helps search engines see your content as valuable.

Scholarships and Alternative Funding Sources

Don’t stop at state aid—scholarships are a lifeline for undocumented students. Organizations like TheDream.US offer up to $33,000 for bachelor’s degrees, open to those without federal access. They have National and Opportunity Scholarships based on your state.

Private scholarships often don’t require citizenship. Check lists from groups like the National Association of Student Financial Aid Administrators (NASFAA) or Immigrants Rising. For 2026, apply early—deadlines start in fall 2025.

Institutional aid varies by school. Universities like the University of Pennsylvania and Stockton University provide need-based packages for undocumented students. Contact admissions to ask about policies.

Private student loans are another option, though rarer without a U.S. cosigner. Lenders like Ascent or MPOWER Finance cater to international and DACA students.

Key Changes to FAFSA for the 2026-2027 Cycle

The 2026 FAFSA builds on prior simplifications. Now with about 46 questions (down from over 100), it’s more user-friendly. Real-time IRS data transfer speeds things up, and the SAI formula expands Pell eligibility for some low-income families.

For noncitizens, no major shifts—eligibility stays limited. But OBBBA adds loan limits: $257,500 lifetime for all federal loans, and caps on Parent PLUS at $20,000/year. These don’t directly impact undocumented students but could affect mixed-status households.

Stay updated via studentaid.gov, as tweaks happen annually.

FAQs on FAFSA for Undocumented Students in 2026

Can undocumented students get any federal aid through FAFSA in 2026?

No, federal aid is reserved for citizens and eligible noncitizens. However, the FAFSA can help access state or school aid.

What if my parents are undocumented but I’m a U.S. citizen?

You can apply for federal aid. Your parents provide info without an SSN— their status doesn’t affect your eligibility.

Are there scholarships specifically for DACA students in 2026?

Yes, like TheDream.US scholarships, which cover up to $33,000 and are open nationwide based on your state.

How do I apply for state aid if I’m undocumented?

Use state-specific apps like California’s CADAA or Illinois’ Alternative Application. Deadlines vary, so check early.

Does DACA status help with FAFSA eligibility?

DACA allows work and an SSN, making form completion easier, but it doesn’t qualify you for federal aid.

Wrapping Up: Take Action on Your College Dreams

Pursuing higher education as an undocumented student in 2026 isn’t easy, but it’s absolutely possible with the right resources. From state aid in places like California and Illinois to scholarships from organizations like TheDream.US, there are paths forward. Start by filling out the FAFSA or your state’s equivalent today—don’t let deadlines slip by.

If you’re ready to explore more, head to your college’s financial aid office or sites like studentaid.gov for personalized advice. And remember, incorporating links to trusted sources (internal ones on scholarship tips, external to FAFSA guides) not only helps you but strengthens the article’s SEO.

Your education is an investment in your future—go grab those opportunities!

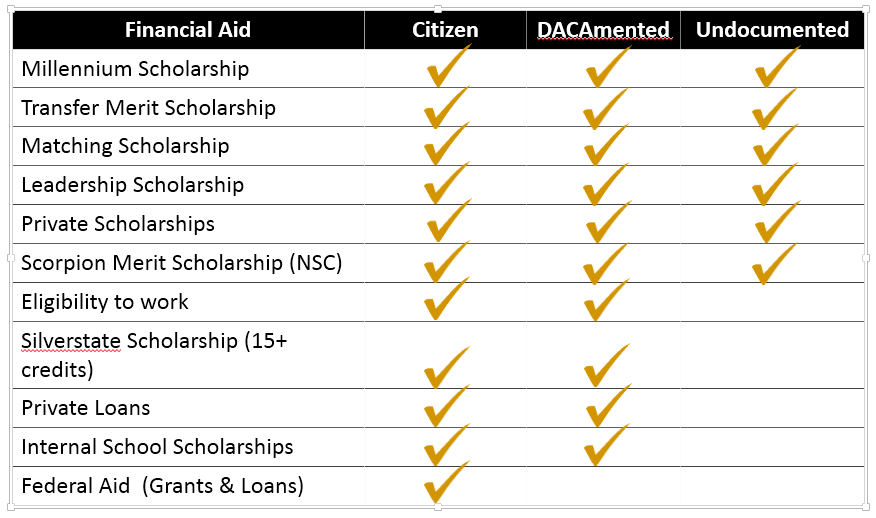

NSC Presents: Undocumented Students – Nevada State University