FAFSA and CSS Profile Differences

FAFSA and CSS Profile Differences: Navigating the world of college financial aid can feel overwhelming, especially when you’re trying to understand the FAFSA and CSS Profile differences in 2026. These two applications are crucial for unlocking grants, scholarships, and loans that make higher education more affordable, but they serve different purposes and come with their own sets of rules.

If you’re a high school senior, parent, or returning student gearing up for the 2026-2027 academic year, knowing how these forms differ can save you time, money, and stress. In this comprehensive guide, we’ll break down everything you need to know, from application processes to eligibility tweaks, all based on the latest updates for 2026.

Whether you’re applying to state universities or private colleges, getting a handle on these differences early can maximize your aid potential. Let’s dive in and demystify the process so you can focus on what matters most—your education.

What is the FAFSA and Why Should You Care About It in 2026?

The Free Application for Federal Student Aid, or FAFSA, is the gateway to federal financial support for college. Administered by the U.S. Department of Education, it’s designed to assess your family’s financial situation and determine eligibility for aid like Pell Grants, federal loans, and work-study programs. For the 2026-2027 school year, the FAFSA continues to emphasize accessibility, building on recent simplifications that make it easier for more families to qualify.

One of the biggest perks of the FAFSA is that it’s completely free—no hidden fees or costs to submit. This makes it an essential first step for anyone seeking aid. In 2026, the form will pull from 2024 tax information, thanks to the prior-prior year reporting system, which allows you to use older, already-filed taxes for quicker completion. This means if you’ve got your 2024 returns handy, you can breeze through sections on income, assets, and household size.

But what’s new in 2026? The FAFSA has undergone further refinements from the FAFSA Simplification Act, which aims to connect more students with aid. For instance, the Student Aid Index (SAI)—which replaced the old Expected Family Contribution (EFC).

Now factors in fewer elements, potentially increasing eligibility for low- and middle-income families. Estimates suggest this could open up Pell Grants to an additional 930,000 students nationwide. If your family income is under certain thresholds, you might see expanded access to need-based aid, including state grants in places like California or New York.

Completing the FAFSA isn’t just about federal money; many colleges use it to award their own institutional aid, and some states require it for scholarships. Take time to gather documents like Social Security numbers, tax returns, and bank statements. The online portal is user-friendly, with built-in tools to import IRS data directly, cutting down on manual entry errors.

Understanding the CSS Profile: A Deeper Dive into Institutional Aid

While the FAFSA covers federal basics, the CSS Profile steps in for a more tailored approach to college-specific aid. Managed by the College Board—the same folks behind the SAT—the CSS Profile is used by around 400 private colleges and universities to distribute their own grants and scholarships. It’s not mandatory everywhere, but if you’re eyeing schools like Harvard, Stanford, or Yale, you’ll likely need to fill it out.

In 2026, the CSS Profile remains a paid application, starting at $25 for the first school and $16 for each additional one. However, fee waivers are available for families with incomes up to $100,000, orphans under 24, or those who’ve qualified for SAT waivers in the past. This makes it more accessible than it sounds, especially since it can unlock substantial institutional aid that the FAFSA alone might miss.

What sets the CSS Profile apart is its depth. It asks for detailed financial info that the FAFSA skips, such as home equity, small business net worth, non-qualified annuities, and even medical expenses. For divorced or separated parents, both custodial and non-custodial parents typically provide data, giving schools a fuller picture of your finances. This customization allows colleges to award aid based on unique circumstances, like high medical bills or regional cost-of-living differences.

For the 2026-2027 cycle, like the FAFSA, it uses 2024 income data. The application opens earlier, on October 1, 2025, giving you a head start compared to the FAFSA’s December 1 rollout. If you’re applying to multiple schools, you can submit once and select recipients, but be prepared for school-specific questions that pop up based on where you’re sending it.

Key FAFSA and CSS Profile Differences in 2026: A Side-by-Side Comparison

To really grasp the FAFSA and CSS Profile differences in 2026, let’s compare them head-to-head. This isn’t just about forms—it’s about how they impact your aid package.

Cost and Accessibility

- FAFSA: Free for everyone. You can send it to up to 20 schools at no extra charge.

- CSS Profile: $25 initial fee, plus $16 per additional school. Waivers available for low-income families, making it free for many who qualify.

The FAFSA wins on cost, but the CSS Profile’s waivers ensure it’s not a barrier for those who need it most.

Application Deadlines and Availability

- FAFSA: Opens on or before December 1, 2025, for the 2026-2027 year. Federal deadline is June 30, 2027, but schools and states have earlier ones.

- CSS Profile: Available starting October 1, 2025. Deadlines vary by school, often aligning with early decision dates around November.

Starting the CSS Profile earlier can give you an edge if you’re applying for early aid consideration.

Financial Information Required

- FAFSA: Focuses on basic income, assets, and household details. Only one parent reports in divorced families. Ignores home equity and weights student assets lower.

- CSS Profile: Digs deeper into non-custodial parent finances, home values, business assets, and expenses like medical bills. Student income and assets are weighted more heavily.

This detail can lead to more personalized aid, but it requires more documentation.

Types of Aid Unlocked

- FAFSA: Primarily federal (Pell Grants, Direct Loans), state, and some institutional aid.

- CSS Profile: Institutional grants and scholarships from private schools, often filling gaps left by federal aid.

Many students need both to get the full picture of available funding.

Who Requires It?

- FAFSA: Required by all U.S. colleges for federal aid.

- CSS Profile: Only about 400 schools, mostly private and selective ones.

Check your target schools’ websites to see if the CSS Profile is needed.

Here’s a quick comparison table for clarity:

| Aspect | FAFSA | CSS Profile |

|---|---|---|

| Cost | Free | $25 + $16/additional (waivers available) |

| Opens | Dec 1, 2025 | Oct 1, 2025 |

| Tax Year | 2024 | 2024 |

| Depth | Basic | Detailed |

| Aid Type | Federal/State | Institutional |

This table highlights why you might need both forms depending on your college list.

What’s New in FAFSA and CSS Profile for 2026?

The landscape of financial aid evolves yearly, and 2026 brings some notable updates. The FAFSA’s ongoing simplification means fewer questions—down to as few as 18 for some applicants—making it faster to complete. The SAI calculation now protects more income, potentially qualifying more families for aid. For example, families with multiple college students won’t see their aid divided as harshly as before.

On the CSS Profile side, there’s increased emphasis on equity for non-traditional families. Schools are using it to address rising costs, with some adjusting formulas to consider inflation and regional expenses. If you’re from a divorced family, expect clearer guidelines on non-custodial contributions, reducing confusion.

Both forms now integrate better with IRS data retrieval, minimizing errors. However, with college costs averaging $26,000 for in-state public schools and over $55,000 for privates in 2026, these updates aim to bridge the affordability gap.

Step-by-Step Guide: How to Apply for FAFSA and CSS Profile in 2026

Ready to get started? Here’s a practical walkthrough.

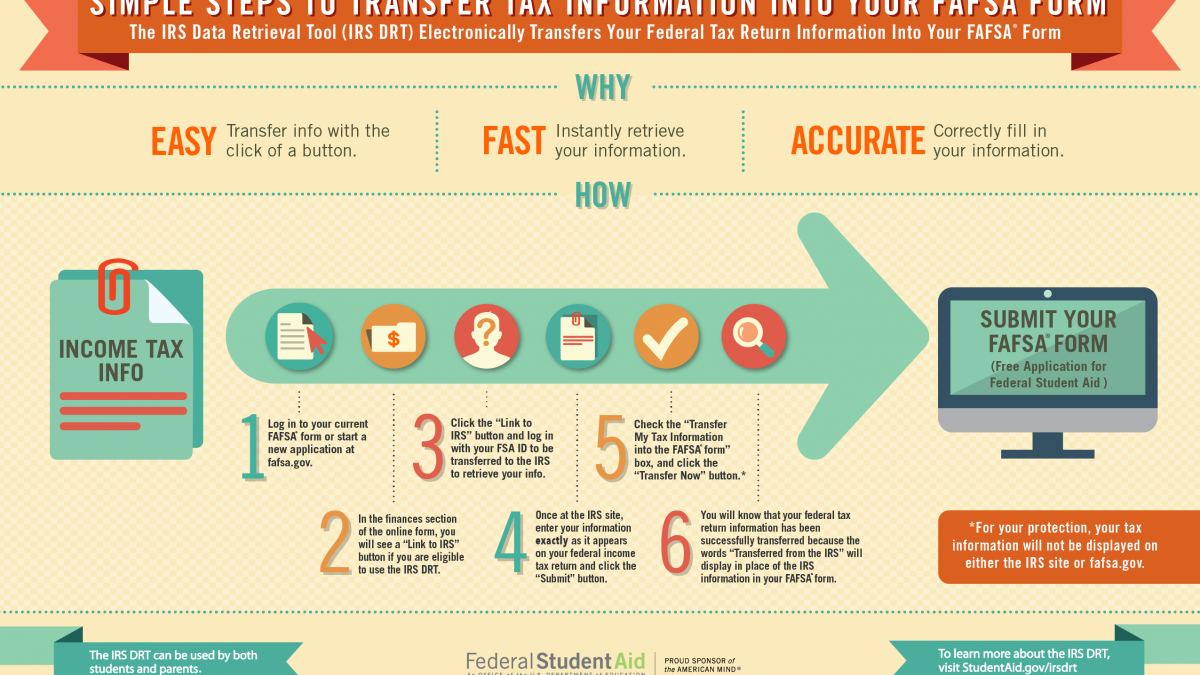

Applying for FAFSA

- Create an FSA ID at StudentAid.gov.

- Gather 2024 tax docs, SSN, and asset info.

- Fill out the online form, using the IRS Data Retrieval Tool for auto-fill.

- List up to 20 schools.

- Submit and review your SAI.

It typically takes 1-3 days for processing.

Applying for CSS Profile

- Sign up at cssprofile.collegeboard.org.

- Provide detailed financials, including any custom school questions.

- Pay or apply for a waiver.

- Submit to selected schools.

Tips for Maximizing Aid and Avoiding Common Pitfalls

To boost your chances, start early—deadlines sneak up fast. Double-check all info to avoid delays; errors can hold up aid for weeks. If you’re in a complex family situation, like divorce, consult a financial aid advisor.

Incorporate internal links in your college planning: For example, link to your school’s financial aid page [internal link: /financial-aid-resources]. Externally, reference trusted sites like StudentAid.gov for FAFSA updates [external link: https://studentaid.gov] or CollegeBoard.org for CSS details [external link: https://cssprofile.collegeboard.org]. These links not only help readers but improve SEO by building authority.

Also, appeal if your situation changes—job loss or medical issues can adjust your aid package.

FAQs: Answering Your Top Questions on FAFSA and CSS Profile Differences in 2026

Do I need to fill out both the FAFSA and CSS Profile?

Yes, if your schools require it. The FAFSA is universal for federal aid, while the CSS Profile is for specific institutional funds.

What’s the deadline for FAFSA in 2026?

Federal is June 30, 2027, but check school and state deadlines, often March or April.

Can I get a fee waiver for the CSS Profile?

Absolutely, if your family income is $100,000 or less, or you meet other criteria like SAT waivers.

How does the CSS Profile handle divorced parents?

Both parents usually report finances, unlike FAFSA’s one-parent rule.

What’s the SAI and how does it differ from the old EFC?

The SAI is the new metric replacing EFC, designed to be more generous and simplify calculations for 2026 applicants.

Final Thoughts: Take Action on Your Financial Aid Journey

Understanding the FAFSA and CSS Profile differences in 2026 is key to securing the aid you deserve. By tackling both forms strategically, you can uncover thousands in grants and scholarships that make college attainable. Don’t wait—head to StudentAid.gov today to start your FAFSA, and check if your dream schools need the CSS Profile.