Loan Forgiveness for Nonprofits in 2026

Loan Forgiveness for Nonprofits in 2026: If you’re working in the nonprofit sector and carrying student loan debt, the idea of loan forgiveness can feel like a lifeline. In 2026, loan forgiveness for nonprofits remains a critical topic, especially with evolving programs like Public Service Loan Forgiveness (PSLF) offering real relief to dedicated public servants.

Whether you’re an employee at a charitable organization or leading one, understanding these opportunities can make a huge difference in your financial future. This guide dives deep into the latest details, including upcoming changes that could impact eligibility starting mid-year.

Nonprofits play an essential role in our communities, from providing healthcare to education and social services. But many workers in this field face hefty student loans from their own education journeys. That’s where loan forgiveness for nonprofits in 2026 comes in.

Programs designed to reward your commitment by wiping out remaining debt after a set period of service. With fresh data showing over $78 billion forgiven for more than 1 million borrowers so far, there’s plenty of reason to explore your options. Let’s break it down step by step, so you can see if you qualify and how to get started.

Understanding Public Service Loan Forgiveness for Nonprofits

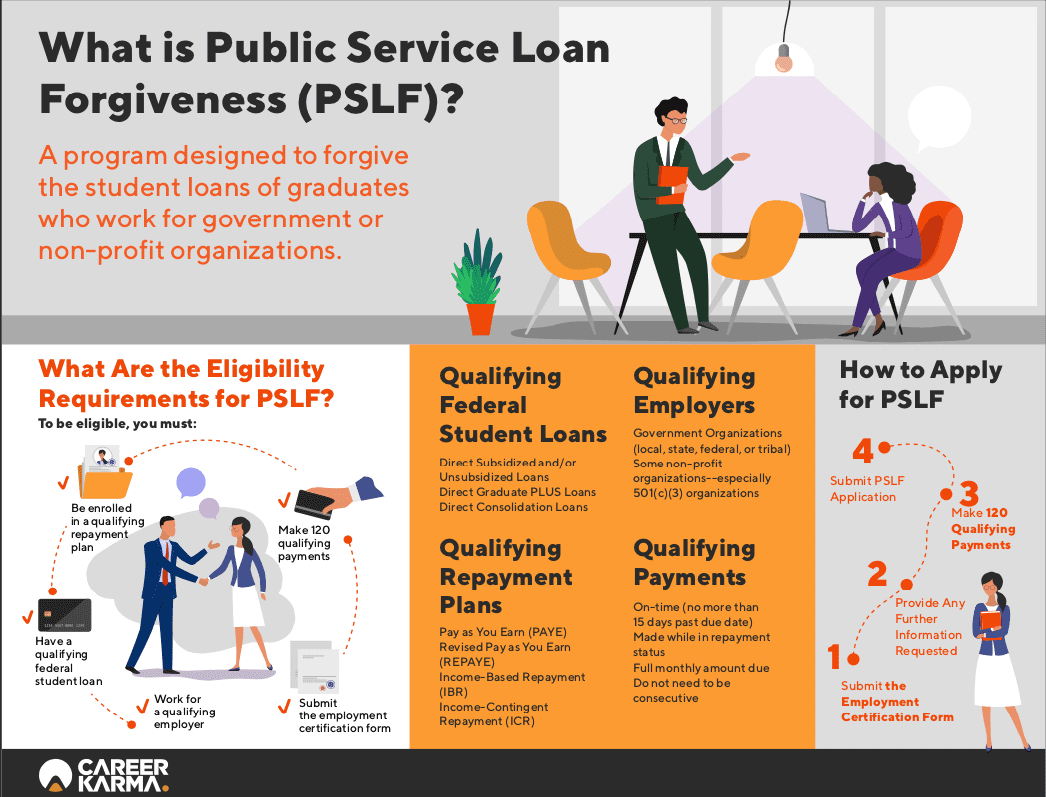

Public Service Loan Forgiveness, or PSLF, is the cornerstone of loan forgiveness for nonprofits in 2026. Launched to encourage careers in public service, it forgives the remaining balance on your federal Direct Loans after 120 qualifying monthly payments—that’s about 10 years of full-time work. For nonprofit employees, this program is particularly appealing because it recognizes the value of your contributions to society.

Imagine dedicating your career to helping others, only to be bogged down by student debt. PSLF changes that narrative. As of early 2026, the program has already helped over 1,069,000 borrowers, with an average forgiveness amount around $73,000. That’s not just numbers; it’s real people—like teachers in underfunded schools or social workers in community centers—getting a fresh start.

But why focus on nonprofits? These organizations often operate on tight budgets, meaning salaries might not stretch as far as in the private sector. Loan forgiveness bridges that gap, making it easier to attract and retain talent. If your employer is a 501(c)(3) tax-exempt nonprofit or provides qualifying public services, you’re likely in the running. Think hospitals, schools, or advocacy groups—the list is broad, but it has to meet federal criteria.

Eligibility Requirements for Loan Forgiveness in Nonprofits This Year

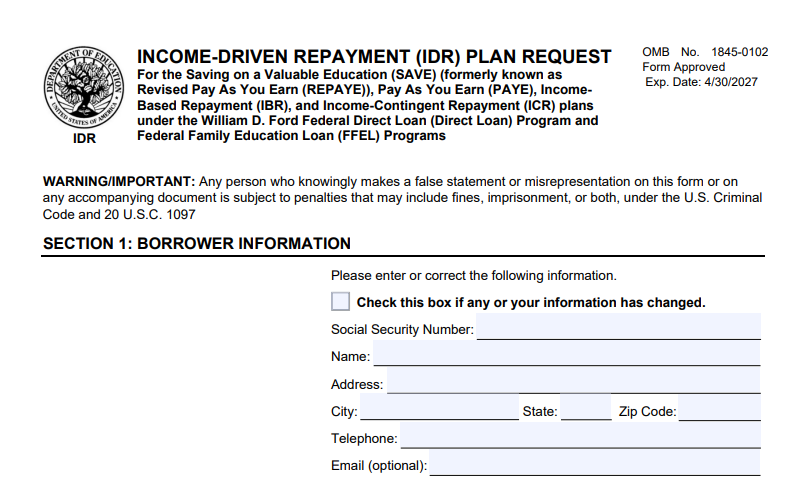

Getting loan forgiveness for nonprofits in 2026 starts with checking the boxes on eligibility. First off, your loans must be federal Direct Loans. If you have other types like FFEL or Perkins loans, you’ll need to consolidate them into a Direct Consolidation Loan to qualify. Don’t worry—consolidation doesn’t reset your payment count if done right.

Next, employment is key. You must work full-time (at least 30 hours per week) for a qualifying employer. For nonprofits, that means 501(c)(3) status or organizations providing public services like education, public health, or law enforcement.

Government jobs count too, but since we’re focusing on nonprofits, know that your org’s mission matters. Use the PSLF Help Tool on the Federal Student Aid website to verify if your employer qualifies—it’s a quick search that can save you headaches later.

Payments are another hurdle. They have to be made under an income-driven repayment (IDR) plan, such as SAVE, PAYE, or REPAYE. These plans base your monthly bill on your income and family size, making them manageable for lower nonprofit salaries.

As of 2026, the new Repayment Assistance Plan (RAP) is rolling out, which could affect how payments are calculated, potentially delaying forgiveness for some to 30 years. But for PSLF, the 10-year timeline still holds if you meet all criteria.

What about part-time work? If you juggle multiple qualifying jobs that add up to 30 hours, that counts. And military service or AmeriCorps time can contribute to your 120 payments. In 2026, with student debt totaling over $1.7 trillion nationally, these details are more important than ever. Always track your progress—submit employment certification forms annually to keep your count accurate.

Major Changes to Loan Forgiveness for Nonprofits Starting July 2026

Heads up: 2026 brings significant shifts to loan forgiveness for nonprofits. The U.S. Department of Education finalized new PSLF rules in October 2025, set to take effect on July 1, 2026. These changes aim to “protect taxpayers” but have sparked controversy among nonprofit advocates.

One big update is the narrowing of employer eligibility. Starting mid-2026, the Department can disqualify organizations if they engage in activities deemed to have a “substantial illegal purpose.” This could include issues like immigration support or certain advocacy work, depending on interpretations.

Critics argue this politicizes the program, potentially affecting thousands of workers in progressive nonprofits. Lawsuits are already underway from states, cities, and organizations challenging these restrictions as unlawful.

Another change: Parent PLUS loans won’t qualify for PSLF after July 1, 2026. If you’re a parent borrowing for your child’s education and working in nonprofits, act now to consolidate or explore alternatives. The new RAP plan replaces several IDR options, extending forgiveness timelines for some borrowers to 30 years, though PSLF’s 10-year rule remains for qualifying public servants.

On the plus side, consolidations after September 2024 use a weighted average for payment credits, making it easier to combine loans without losing progress. But with potential denials based on employer activities, nonprofits need to review their operations. As of February 2026, over 14,000 comments opposed these rules during the proposal phase, showing widespread concern.

If your organization might be affected, consider consulting legal experts or joining advocacy groups like the Council of Nonprofits for updates. These changes could reshape loan forgiveness for nonprofits in 2026 and beyond.

Other Loan Forgiveness Options Available to Nonprofits in 2026

PSLF isn’t the only game in town for loan forgiveness for nonprofits in 2026. Depending on your role, other programs might fit better or stack with PSLF.

Take the National Health Service Corps (NHSC) Loan Repayment Program. If you’re a health professional in a nonprofit clinic or hospital, you could get up to $50,000 in forgiveness for two years of service in underserved areas. The 2026 application cycle is open through March 31, 2026—perfect for doctors, nurses, or dentists in qualifying spots.

Teachers in nonprofits have options too. Teacher Loan Forgiveness offers up to $17,500 for five years of teaching in low-income schools. If you’re in special education or math/science, you might qualify for more. Perkins Loan Cancellation is another gem for educators, forgiving up to 100% over five years.

For broader roles, state-specific programs abound. California’s State Loan Repayment Program, for example, targets health workers in nonprofits. Nationwide, there are over 140 forgiveness programs, from federal to local levels. Even if PPP loans ended in 2021, some lingering SBA forgiveness might apply if you have outstanding balances, though no new initiatives for 2026.

Stacking programs? Possible, but rules vary. PSLF can work alongside Teacher Forgiveness, but you can’t double-dip on the same payments. Research thoroughly to maximize benefits.

Step-by-Step Guide: How to Apply for Loan Forgiveness as a Nonprofit Employee

Applying for loan forgiveness for nonprofits in 2026 doesn’t have to be overwhelming. Start with the PSLF Help Tool—it’s your best friend for generating forms and checking eligibility. Log in to StudentAid.gov, enter your employer’s details, and see if they qualify.

Step one: Consolidate if needed. Head to the consolidation application online—it’s free and quick.

Step two: Enroll in an IDR plan. Use the same site to apply based on your income. In 2026, with RAP incoming, choose wisely to keep payments low.

Step three: Certify employment. Submit the PSLF form annually or when switching jobs. Your employer signs off on your full-time status. Digital submission is easiest, but paper works too.

Once you hit 120 payments, submit the final form. The servicer reviews, and if approved, your balance vanishes—tax-free under current laws.

Tips for success: Keep records of everything. If denied, appeal—many early rejections were due to paperwork errors, but fixes like the Limited PSLF Waiver (ended in 2022) showed persistence pays off. In 2026, with new rules looming, apply early to lock in progress.

The Benefits of Loan Forgiveness Programs for Nonprofit Organizations

Loan forgiveness for nonprofits in 2026 isn’t just about individual relief—it’s a boon for organizations too. By promoting PSLF, nonprofits can recruit top talent without competing on salary alone. Imagine advertising a position with “potential for full loan forgiveness after 10 years”—that’s a powerful incentive.

Data backs this up: Nonprofits using PSLF as a perk see higher retention rates. In a sector where turnover is high due to burnout and low pay, this stability helps missions thrive. Plus, forgiven loans mean employees have more disposable income, potentially boosting donations or volunteer hours back into the community.

For leaders, educate your team. Host workshops or share resources from sites like the Nonprofit Student Debt Project. It fosters loyalty and positions your org as employee-focused. In 2026, with economic pressures, these benefits could be key to sustainability.

Challenges and Controversies Surrounding Loan Forgiveness in 2026

No program is without hurdles. For loan forgiveness for nonprofits in 2026, the biggest challenge is the July changes. The “substantial illegal purpose” clause could lead to arbitrary denials, affecting orgs in immigration or social justice. Lawsuits from groups like the American Council on Education argue it’s an overreach.

Processing delays have plagued PSLF historically, though improvements like digital tools help. In 2026, with SAVE plan ending and RAP starting, borrowers might face confusion. Tax implications? Forgiven amounts are nontaxable for PSLF, but watch for changes in other programs.

Nonprofits should advocate—join coalitions pushing back against restrictions. The future of these programs depends on public support.

FAQs About Loan Forgiveness for Nonprofits in 2026

What is the main loan forgiveness program for nonprofit employees in 2026?

The primary one is Public Service Loan Forgiveness (PSLF), which cancels remaining federal Direct Loan balances after 120 qualifying payments while working full-time for a qualifying nonprofit.

How do the July 2026 changes affect nonprofit eligibility for PSLF?

Starting July 1, 2026, employers could be disqualified if deemed to have a “substantial illegal purpose,” potentially impacting certain advocacy groups. Lawsuits are challenging this.

Can I still apply for NHSC loan repayment in 2026?

Yes, the FY 2026 application is open until March 31, 2026, for health professionals in underserved nonprofit settings.

Do part-time nonprofit jobs count toward loan forgiveness?

Only if combined roles total at least 30 hours per week across qualifying employers.

What should I do if my PSLF application is denied in 2026?

Appeal the decision, double-check paperwork, and consider consulting a student loan expert. Many denials are fixable.

Final Thoughts: Take Action on Loan Forgiveness for Nonprofits Today

Loan forgiveness for nonprofits in 2026 offers tremendous potential, but with changes on the horizon, don’t wait. Check your eligibility, submit certifications, and stay informed about updates. Whether through PSLF or other programs, relieving debt lets you focus on what matters—making a difference.

Ready to start? Visit StudentAid.gov today to use the PSLF Help Tool and begin your journey. If you’re a nonprofit leader, share this with your team—it could change lives. For more tips on managing finances in the sector, explore our related articles on nonprofit budgeting [internal link to nonprofit budgeting guide] or external resources like the Council of Nonprofits [external link to councilofnonprofits.org]. Your future self will thank you.