Doctor Loan Forgiveness in 2026

Doctor Loan Forgiveness in 2026: If you’re a physician staring down a mountain of student loans, you’re not alone. The average medical school graduate enters the workforce with over $200,000 in debt, and that number keeps climbing with rising tuition costs. But here’s the good news: doctor loan forgiveness in 2026 offers more opportunities than ever to wipe out a significant portion of that burden.

Whether you’re in primary care, specializing in underserved areas, or working for a nonprofit, programs at both federal and state levels can help you pay off loans faster while serving communities that need it most. In this guide, we’ll break down the latest updates, eligibility rules, application tips, and strategies to maximize your forgiveness potential—all tailored to the realities of 2026.

As we dive into the details, keep in mind that these programs aren’t just about financial relief; they’re designed to encourage doctors to fill critical gaps in healthcare. With recent policy shifts, including tighter rules on federal loans and enhanced awards for high-need roles, 2026 is a pivotal year for physicians seeking loan forgiveness. Let’s explore how you can take advantage.

What Is Doctor Loan Forgiveness and Why It Matters in 2026?

Doctor loan forgiveness refers to programs that cancel or repay a portion of your student loans in exchange for service in specific roles or locations. These initiatives target physicians because the U.S. faces ongoing shortages in areas like rural medicine, primary care, and behavioral health. In 2026, with healthcare demands amplified by an aging population and post-pandemic recovery, these programs are more vital—and competitive—than ever.

According to recent data from the Association of American Medical Colleges, nearly 70% of medical students graduate with debt, and repayment can stretch over 20-30 years without intervention. But forgiveness options can slash that timeline dramatically. For instance, federal programs like the National Health Service Corps (NHSC) Loan Repayment Program have boosted awards this year to address shortages, offering up to $75,000 for full-time primary care physicians in high-need areas. This is a jump from previous years, reflecting the government’s push to retain talent in underserved communities.

Why focus on 2026? Major changes from the One Big Beautiful Bill Act (OBBBA) kicked in last year, affecting everything from loan limits to forgiveness taxability. Starting July 1, 2026, new graduate borrowers face caps on federal loans—$50,000 annually and $200,000 lifetime for professional degrees like medicine. Plus, most income-driven repayment (IDR) forgiveness becomes taxable again, potentially leading to big tax bills. These shifts make proactive planning essential for doctors aiming to minimize debt.

To boost your article’s SEO, incorporate internal links to related content on your site, such as a guide to “medical residency financing” or “physician salary trends.” Externally, link to authoritative sources like the Department of Education’s PSLF page for credibility and better search rankings.

Federal Doctor Loan Forgiveness Programs Available in 2026

The federal government leads the charge with robust programs for physician loan forgiveness. These are often the most generous, but they come with service commitments. Here’s a rundown of the key ones updated for 2026.

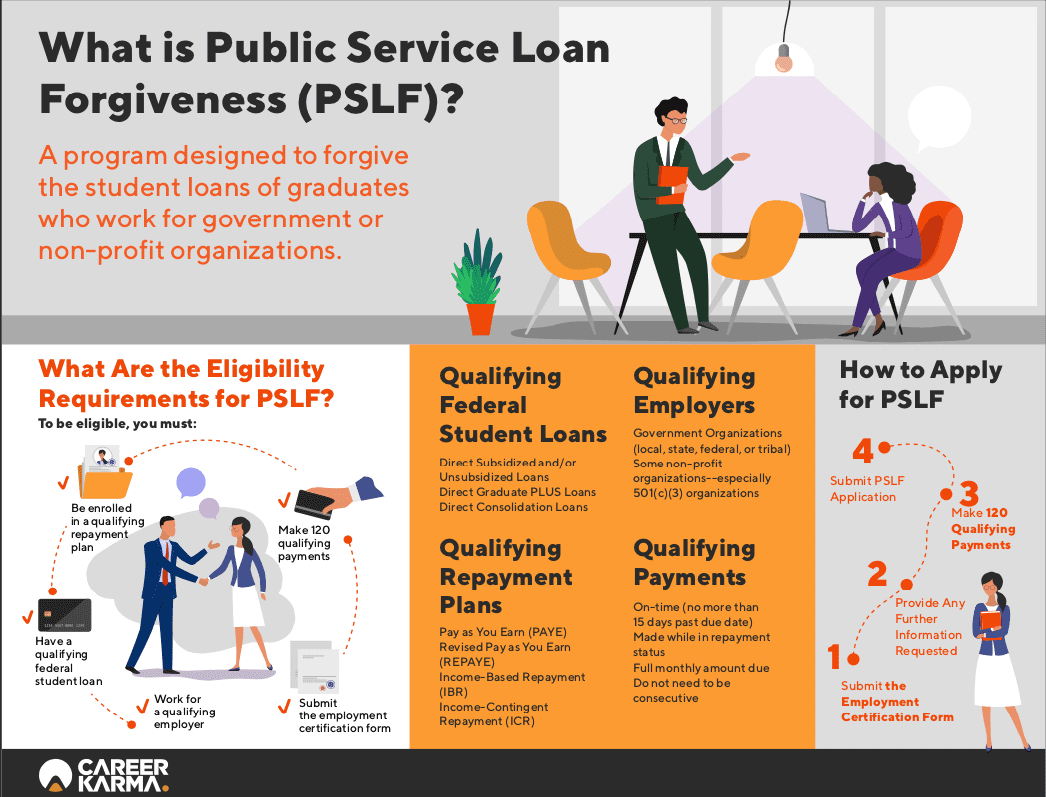

Public Service Loan Forgiveness (PSLF) for Physicians

PSLF remains a cornerstone for doctors working in nonprofits or government hospitals. After 120 qualifying payments (about 10 years) on an income-driven plan, your remaining federal direct loans are forgiven tax-free. However, 2026 brings tweaks: Residency and fellowship years no longer count toward those payments, extending the timeline for many new docs. Also, a new rule effective July 1 excludes employers with “substantial illegal purposes,” though this impacts few organizations.

In 2026, PSLF is ideal for physicians in public health roles. Over 1 million borrowers have already received forgiveness nationwide, including thousands of doctors. To qualify, consolidate non-direct loans and submit annual employment certification forms. Tip: Use the PSLF Help Tool on StudentAid.gov to track progress.

National Health Service Corps (NHSC) Loan Repayment Program

The NHSC LRP is a game-changer for primary care doctors. Applications for FY 2026 are open until March 31, 2026, at 7:30 p.m. ET. In exchange for two years of service in a Health Professional Shortage Area (HPSA), you can get up to $75,000 for full-time work or $37,500 for half-time—up from previous amounts to combat shortages. Primary care physicians, including those in family medicine, pediatrics, and internal medicine, see the highest awards.

Special variants include the NHSC Substance Use Disorder Workforce LRP and Rural Community LRP, both open through the same deadline, offering similar benefits for behavioral health and rural specialists. With over 13,000 sites eligible nationwide, this program has helped forgive billions in debt.

NIH Loan Repayment Programs

For research-oriented doctors, the National Institutes of Health (NIH) LRPs provide up to $50,000 annually for two years, renewable. Applications for extramural awards (outside NIH) run from September 1, 2025, to December 4, 2025, with awards starting July 1, 2026. Focus areas include clinical research, pediatrics, and health disparities—perfect for academic physicians.

In 2026, these programs prioritize emerging fields like biomedical research, with over 1,300 awards granted last cycle. Service involves dedicating at least 20% of your time to research.

Other federal options include the Indian Health Service LRP and military programs like the Health Professions Loan Repayment for active-duty doctors.

For SEO enhancement, link externally to the NHSC application portal here and internally to a post on “choosing a medical specialty for loan forgiveness.”

State-Specific Physician Loan Forgiveness Options in 2026

Beyond federal aid, states offer tailored programs to keep doctors local. These often stack with federal forgiveness, amplifying your relief. Here’s a snapshot of notable ones in 2026.

Texas Physician Education Loan Repayment Program

Texas provides up to $180,000 over four years for physicians in shortage areas or serving Medicaid patients. Applications are annual, with 2026 tax info available starting January 25. Primary care and rural docs get priority.

Ohio Physician Loan Repayment Program

Ohio offers up to $80,000 for full-time service or $20,000 yearly for four years in underserved areas. It’s competitive, focusing on family practice and psychiatry.

Colorado Health Service Corps

Colorado repays up to $90,000 for three years of service in HPSAs, including for dentists and behavioral health pros alongside physicians. The Nurse Faculty LRP variant supports educators.

Other standouts: Arizona’s program for primary care in rural areas, New York’s Regents Physician Loan Forgiveness (up to $10,000 yearly for underserved practice), and Kansas’ up to $20,000 annual for HPSA staff. Check your state’s health department for deadlines—many align with federal cycles.

To optimize SEO, create a table comparing state programs (below) and link to state sites externally.

| State | Max Forgiveness | Service Requirement | Key Focus |

|---|---|---|---|

| Texas | $180,000 | 4 years in shortage areas | Primary care, Medicaid |

| Ohio | $80,000 | 2-4 years full-time | Underserved communities |

| Colorado | $90,000 | 3 years in HPSAs | Broad health professions |

| Arizona | Varies | 2 years rural/primary | Family practice, pediatrics |

| New York | $10,000/year | Underserved areas | Increasing physician numbers |

Eligibility and Application Tips for Medical Loan Forgiveness in 2026

Qualifying for doctor loan forgiveness in 2026 starts with the basics: U.S. citizenship or eligible non-citizen status, a valid medical license, and outstanding federal or private loans (though most programs target federal). Service in HPSAs or nonprofits is common.

For PSLF: Full-time employment (30+ hours/week) at a qualifying employer, direct loans, and IDR plan enrollment. NHSC requires a two-year commitment in high-need sites.

Application pro tips:

- Gather docs early: Loan statements, employment verification, tax returns.

- Apply during open windows—e.g., NHSC closes March 31, 2026.

- Stack programs: Combine NHSC with PSLF for max forgiveness.

- Track payments: Use apps or federal tools to avoid miscounts.

Challenges? Competition is fierce, and service sites may be rural. But benefits include debt relief, career fulfillment, and sometimes relocation bonuses.

Benefits, Challenges, and Strategies for Success

The perks of pursuing doctor loan forgiveness in 2026 are clear: Faster debt payoff, tax-free relief in many cases, and meaningful work. A primary care doc could erase $75,000 in two years via NHSC, plus PSLF for the rest.

Drawbacks include long commitments and potential tax hits on IDR forgiveness post-2025. Strategies: Refinance private loans separately, consult a financial advisor, and monitor updates via AAFP or AAMC resources.

For SEO, embed external links to tools like the AAMC loan database here and internal to “debt management for residents.”

FAQs on Doctor Loan Forgiveness in 2026

What are the best doctor loan forgiveness programs for primary care physicians in 2026?

The NHSC LRP tops the list with up to $75,000 for two years in HPSAs, plus state options like Texas’ program.

Can residency count toward PSLF in 2026?

No, under new rules, residency and fellowships don’t qualify for PSLF credit starting this year.

Is student loan forgiveness taxable for doctors in 2026?

PSLF and NHSC remain tax-free federally, but IDR forgiveness (like under SAVE) is now taxable unless exempted.

How do I apply for state-specific physician loan forgiveness?

Check your state’s health department; many require annual applications and service in shortage areas.

What if I’m a specialist—do I qualify for medical loan forgiveness in 2026?

Yes, programs like NIH LRP for researchers or NHSC SUD for behavioral health specialists offer options beyond primary care.

Final Thoughts: Take Action on Your Doctor Loan Forgiveness Today

Navigating doctor loan forgiveness in 2026 might seem daunting, but with updated programs offering higher awards and targeted relief, it’s an opportunity to reclaim your financial freedom. Whether through federal heavyweights like PSLF and NHSC or state incentives, you can significantly reduce your debt while making a difference.

Don’t wait—review your loans, check eligibility, and apply before deadlines like March 31 for NHSC. Consult a specialist for personalized advice, and start your journey toward a debt-free future. Ready to explore more? Contact a financial planner or visit StudentAid.gov to get started.